Fraud and Character

Our psychologist Dr. Michael Greelis and our CEO Michael Pocalyko (they are both on our government contracts) have advanced a new theory of the Psychology and Motivations of White-Collar Criminals. We’re sharing here as a long-form SI blog post the Greelis and Pocalyko top-level findings, as originally presented to the Association of Certified Fraud Examiners Global Fraud Conference.

Individual cases of criminality are reported frequently, [but] in many periods more important crime news may be found on the financial pages of newspapers than on the front pages.

Why do people commit financial fraud against the businesses that employs them? Do they lack the resources to fund their lifestyle? Are they under pressure to meet revenue targets that result in executive bonuses? Is there an underlying hostility towards the corporation or the government entity? The motivations giving rise to these questions may be present in a major portion of white-collar crime. However, all of them fail to address the underlying mechanism that enables almost all fraudulent activities comprising white-collar crime.

White-collar crime is a type of fraud that is materially different from organizational fraud. Both types of fraud are in the same dominion: they generally take place in the office environment and involve schemes manipulating accounting and finance systems. White-collar crime differs, however, in the driving motivations of its perpetrators, in the basic bad character of these fraudsters, in the entitlement that they inherently exhibit, and in the undergirding psychopathology of the white-collar criminal. All of these characteristics contrast with the opportunistic, rationalizing, and often guilt-ridden-when-caught fraudsters of “regular” occupational fraud.

This kind of fraudster wants, and takes, regardless of the circumstances.

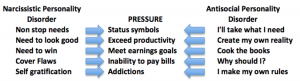

We will build a case to demonstrate that most instances of fraud presenting as white-collar crime require a pervasive set of assumptions and values characterized by two well-known personality disorders: Narcissistic Personality Disorder (DSM-5 301.81, F60.81) and Antisocial Personality Disorder (DSM-5 301.7, F60.2). These two disorders are the foundation enablers for motivations of white-collar criminals, and they are like those described in Donald Cressey’s fraud triangle.

Before making that argument, let’s look at the theoretical basis for the class of corporate financial fraud that is commonly known white-collar crime.

Key Theories of White Collar Crime: Sutherland Defines the Field

Edward H. Sutherland outlined the first comprehensive theory of white-collar criminal behavior in his 1940 article White Collar Criminality. The theory and explanations that he offered are highly applicable today despite the more than eighty years since the study’s publication.

Sutherland began by noting that there was a prevailing view among sociologists of the era that criminal behavior was generally associated with the lower social classes. Theft, assault, homicide and other crimes were seen as interpersonal events involving a criminal living in poverty in “slum neighborhoods” who committed crime in order to survive, or as a result of feeblemindedness or serious mental illness. The foundation for this criminal class consisted of deteriorated families. Defined in these terms, crime from the lower classes produced noticeable numbers in terms of criminal acts and subsequent incarcerations.

Sutherland refuted this dominant perception of criminal behavior by naming and defining what he called white-collar crime. It wasn’t the lower classes, but rather business and professional men who committed these types of crimes. There may not be as many individuals committing these white-collar crimes as there were criminals committing robberies, assaults, but the impact of their criminality, he argued, was far greater on society. He referenced food poisoning that occurred on a massive scale with the full knowledge of specific food industry executives. He cited a Securities and Exchange Commission study that found misleading information in 80% of corporate filings. Another investigation uncovered some form of financial crimes in 75% of banks studied by the Comptroller of the Currency. Sutherland provided exhaustive documentation of white-collar crime including financial manipulation, unfair labor practices, restraint of trade, fraudulent rebates, misrepresentation in advertising, and infringements on patent and trademarks.

Sutherland then divided white-collar crime into two broad categories: “misrepresentation of asset values and duplicity in the manipulation of power.” He concluded his seminal article by providing an alternative theory about the origins of all criminal behavior:

“The hypothesis is that . . . white collar criminality, just as other systematic criminality, is learned; that it is learned in direct or indirect association with those who already practice the behavior, and that those who learn this criminal behavior are segregated from frequent and intimate contacts with law aboding behavior. Whether a person becomes a criminal or not is determined largely by the comparative frequency and intimacy of his contacts with the two types of behavior.”

Key Theories of White Collar Crime: Cressey’s Fraud Triangle.

Donald R. Cressey built on Sutherland’s sweeping theory of white-collar crime but in doing so, he questioned the process that leads to crimes—he was especially interested in the undergirding psychology, character, and motivations of persons who commit them. He interviewed 133 incarcerated white-collar criminals, men who met Sutherland’s definition at the time. Cressey dismissed Sutherland’s conclusion that white-collar crime resulted from those who associate with those “who already practice the behavior.” In its place, he introduced the fraud triangle, which has since become the grounding basis for our understanding of occupational fraud in professional workplaces and in fraud on systems of finance and accounting.

Cressey proposes a three-step process. The first step is critical since it describes how, in his advanced construction, a person becomes a white-collar criminal: “Trusted persons become trust violators when they conceive of themselves as having a financial problem . . . ” Once that trusted person within a financial system becomes a violator, both an opportunity to solve the problem and a rationalization then justify the crime.

The fraud triangle has become widely accepted as an explanation for white-collar crime and a guide to the prevention of occupational fraud. Companies are encouraged to implement proactive measures to prevent this crime. These measures include an open corporate environment where skilled and caring managers encourage stressed individuals to open up about their personal financial pressures; tight financial controls to reduce opportunities for fraud; excellent information systems controls for anti-fraud measures; and a zero tolerance for any type of financial fraud. Because of the nature of financial fraud and business confidentiality, it is difficult to gather a great deal of hard data on the effectiveness of this approach—although the number of consulting firms advertising the fraud triangle as the centerpiece of their approach indicates strong anecdotal evidence to support of the efficacy of the theory.

The Need for a New Underlying Theory to Identify Fraudsters Predisposed to White-Collar Crime

Prevention and punishment are important elements to solve the problem of white-collar crime in general and to prevent or recover the resulting losses. What if we had an empirically-based system developed over decades that would allow us to draw a bright line around the types of individuals who are most likely to commit fraud? We do. The system is found in the personality disorders outlined in the American Psychiatric Association’s Diagnostic and Statistical Manual, Fifth Edition (DSM-5). All of us have personalities. They are one of the most important ways that we are distinguished as persons—fundamental to our humanity, and to the way we relate to other people. Our personalities are with us at all times, providing the filter by which we interpret the world around us and forming the basis for our actions in that world.

For Cressy, and in our current understanding of workplace fraud, financial pressure and opportunity act together on a susceptible personality to make a possibly otherwise honest person commit white-collar crime.

We suggest that a certain kind of person can be psychologically predisposed to commit white-collar crime—even without pressure, and even if that person is already enjoying an extraordinary lifestyle and significant personal financial resources.

Two personality disorders overlap to describe the essential elements that form the foundation for an act of financial fraud: Narcissistic Personality Disorder and Antisocial Personality Disorder. These syndromes are based on decades of research and refinement backed by rigorous quantitative scientific study. They are conditions of personality that can be identified by interviews and observation by qualified professionals, and they can be measured as a percent of the total population.

Personality is to the personality disorders giving rise to specific mental illnesses (e.g., depression) as the immune system is to specific physical illnesses (e.g., the common cold). An individual with a strong immune system is less likely to have a physical medical disorder. Individuals with a reality-based personality, absent the various personality disorders, are much less likely to struggle with self-created problems, and they are in turn less likely to experience clinical depression, anxiety, trauma and other specific psychiatric disorders.

Two specific disorders explain the underlying motivation for white-collar crime.

Individuals with Narcissistic Personality Disorder (“narcissists”) are preoccupied with their sense of self and their appearance in the world. They are driven to suppress even the slightest appearance of inadequacy through the maintenance of a carefully, thoroughly curated public persona of benevolence, success, talent or any combination of what society generally perceives as positive traits. They absolutely require that these positive traits should be ascribed to them. Narcissists seek positive reinforcement at all times and at all levels of their lives.

Individuals with Antisocial Personality Disorder (“antisocials”) seek “concrete gain by any means.” Their typically normal presentation to the world masks a non-stop process of evaluating their environment for opportunities to meet what they perceive to be their particular needs—through money, property, power, or people. Antisocials are able to size up situations quickly and manipulate people involved in those situations to cooperate with their schemes. They generally lack insight into anything except their own “needs” and often, but not always, act on a whim. Antisocials have a huge advantage over the rest of us. We often misunderstand the main reason for their behavior. Because these people are often very successful in large organizations and in business, we naturally assign merit to their success when, in fact, their success flows from a series of subversions, betrayals, and nonstop rule breaking.

In a very real way, the activating pressure step of the fraud triangle is often preceded by narcissistic “needs.” These needs when activated turn into action through the intrapersonal sanctions of Antisocial Personality Disorder. The following graphic illustrates the foundation of non-stop needs and the activating entitlement of guilt-free rule breaking.

Ultimately, the white-collar criminal follows this simple logic: I need therefore I take.

We submit that there is a new dimension of white-collar crime, one that is an outgrowth of the work of Cressy and Sutherland, and one that we are only beginning to understand fully.

Sutherland first saw the danger of white-collar criminals whose motivations and criminal character were shaped by the pressure of externalities—beginning with the economic environment of the Great Depression, when Sutherland began his empirical studies. Genuine financial pressure from external factors (whether or not they may be caused by the individual) are real indicators and triggers for occupational fraud and white-collar crime.

Narcissistic “needs” coupled with the successful subversions and rule-breaking of Antisocials result in a different motivation for white-collar crime, analogous to the pressure of financial externalities, but just as real and compelling to the criminal. This kind of pressure is internal. It is driving, motivating, and quite all-consuming. It lacks basic morality and any sense of psychological centeredness, and it exists no matter how wealthy, successful, or self-assured an individual may present to the outside world. The person who exhibits these characteristics of Narcissistic Personality Disorder and Antisocial Personality Disorder places a business or an organization at risk for white-collar crime.

Sutherland was right.

Headlines are replete with the stories of white-collar criminals. Wells Fargo agrees to pay $3 billion to resolve criminal and civil investigations into sales practices involving the opening of millions of accounts without customer authorization. Theranos and Elizaberth Holmes perpetrated the most massive fraud in American history, while its marquée board of directors turned a blind eye. “Pharma Bro” Martin Shkreli increased the price of a lifesaving anti-parasitic medication from $13.50 to $750 a pill without regard to the health impact on the drug’s existing patients. Mylan Pharmaceuticals jacked up the price of EpiPens—the only means to reverse fatal allergic reactions—from $100.00 to $600.00 because they could, for no reason other than to inflate profits and increase management compensation. In the run-up to the Great Recession of 2008, there were Wall Street firms that guiltlessly created inflated values, the exact conditionality for a real estate market crash that cost Americans a total of $8 trillion in savings, 401K value, and homeowner equity. Many of the professionals at those firms received handsome cash and equity bonuses for their work, funded largely by the very people whose financial foundations they crashed.

Companies should make a profit—they have to, or they go out of business. But the willingness of certain kinds of people to profiteer unreasonably, illegally, and unethically by causing shortages of vital medication and products, or to disappear $8 trillion in estate value, required a single-minded focus on meeting one’s own “needs” and ignoring any bothersome legal and ethical limitations that get in the way.

Doing so required adherence to the credo of the Narcissist-Antisocial, the epigram of the white-collar criminal:

I want therefore I take, regardless of the circumstances.